Do I Need An Ni To Register A Company In Uk

A lot of the states digital nomads, serial expats, and others in the location-independent crowd can live and piece of work from anywhere because we run our own contained businesses.

Just no matter if yous're an indie maker, consultant, spider web developer, or mindfulness motorcoach you're likely to take run into the nightmare which is business banking for small and/or location-contained businesses.

Yous've probably already learned that about business banks accounts:

- Are ridiculously hard (if fifty-fifty possible) to open

- Accuse you an arm and a leg in fees

- Screw yous over on the exchange rate when converting currencies

While I've covered most of the cheap and easy to open up personal banking concern accounts in major countries worldwide, I have nonetheless to practise the same for business bank accounts that can exist opened online—from anywhere. Until now.

Table of Contents ↺

- International

- Wise Business

- Airwallex

- Payoneer

- United States

- Mercury

- Relay

- Europe

- Holvi

- N26

- Monese

- Tide

- Starling Bank

- Bunq

- Paysera

- Asia

- Aspire

- Neat

- Other banks and regions

I want to be a chip more liberal with the "banking" term this time around. Virtually business accounts that are low toll and easy to open remotely for near people are offered by fintech companies (a.k.a. neo or challenger banks), oftentimes without full banking licenses.

In practice, this distinction isn't always that important, since these companies are yet regulated and your funds are typically held in segregated accounts with solid partner banks.

In this article, I accept listed all the banks and bank-like services relevant for anyone running a small, international business. Since many of us run companies registered in a country where nosotros're not (full time) resident, I've focused on those that are easy to open and manage remotely, fifty-fifty if you're not a legal resident in the country of the bank.

While some of these concern banking concern accounts are available no affair where your visitor is registered, some crave that y'all have a company in their jurisdiction. For the latter, I've focused on pop location-independent business jurisdictions, such every bit the The states, United kingdom, Hong Kong, and the Eu (including Estonia).

International

Let's start with the international category, which I ascertain as companies offering banking services with local banking concern details in several important jurisdictions.

These allow you lot to receive payments from customers across the world, as if you lot had a real bank account in their country. Some (like Wise) also help you save loads of money on currency conversion costs.

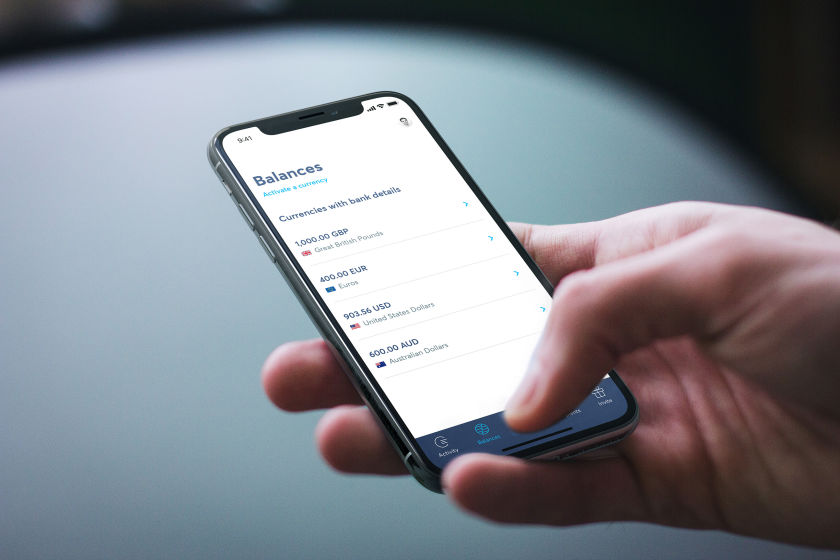

Wise Business (formerly TransferWise)

I retrieve Wise'southward "borderless" business organisation business relationship production is one of the best things that happened to the states digital nomads and location-independent entrepreneurs—at least when information technology comes to simplifying our business concern finances and saving on fees. I've been using it for every single one of my companies in contempo years.

In case you haven't already heard about information technology, let me briefly explain what information technology is:

Wise at present lets yous open business (and personal) banking concern-like accounts in the United States (with total ACH and wire details), United Kingdom (with local account number and sort code), the Eurozone (Germany or Beligium) (with a full IBAN), Republic of hungary (with local business relationship number), Commonwealth of australia (with local account number and BSB code), New Zealand (too with a local account number), and almost recently Singapore (local account number with DBS Banking company). Additionally, Romanaian IBAN is available for residents of Romania and the UK.

All of these accounts are in the name of your visitor—and unlike Payoneer yous can accept any blazon of (legal or non-restricted) payments and outgoing transfers also come from your company name.

You can besides open up currency wallets in more than l other currencies, although you don't get unique bank details for these (yet).

Not only that—but yous also become a free debit carte du jour linked to your account. There are no fees for spending in the currencies y'all concur in your account, and for any other currencies you get Wise'southward low exchange fees (oft around 0.five% markup) on tiptop of the true interbank/mid-market rate!

If you use Stripe to sell products or services online in different currencies (e.g. EUR, USD, GBP, AUD, and NZD) you tin link those accounts to Stripe and save the 2% currency exchange fee they commonly charge.

The same goes if you accept income from due east.yard. Amazon or other sources in unlike countries and currencies. They are a member of the Amazon payment service provider program, which means that you can now use Wise to receive whatsoever sales earnings in over 50 different currencies, making information technology smashing for ecommerce businesses, dropshippers, and wholesale companies. Read here for more info about Wise for ecommerce businesses.

Wise Business at a glance

Highlights

-

Open up for both freelancers and businesses registered in nearly of the world

. Exceptions listed here.

-

Supports 50+ currencies, with unique depository financial institution details in the Eurozone

(Belgium

), Hungary

, United kingdom of great britain and northern ireland

, U.s.a.

, Commonwealth of australia

, New Zealand

, and Singapore

. Romanaian

IBANs are available for UK and Romanian residents.

-

Comes with free debit card for concern expenses (available in the UK, Eu/EEA, Switzerland, Commonwealth of australia, New Zealand, and Singapore at the moment, US and others coming soon).

-

Low fees

for currency commutation and outbound money transfers. No fees for sending to other Wise users.

-

£200 of gratuitous greenbacks withdraws

per calendar month. (But who withdraws greenbacks from their business account anyhow?)

-

Great for east-residents

using Xolo to manage their business—or anyone else using Xero for accounting—thank you to directly integrations.

-

Bachelor both on web

, iOS

, and Android

.

-

USD, EUR, GBP, and AUD accounts supports direct debit, other currencies will follow.

-

Regulated by the FCA (Fiscal Carry Authority)

in the UK

equally an due east-money provider.

Things to note

Airwallex

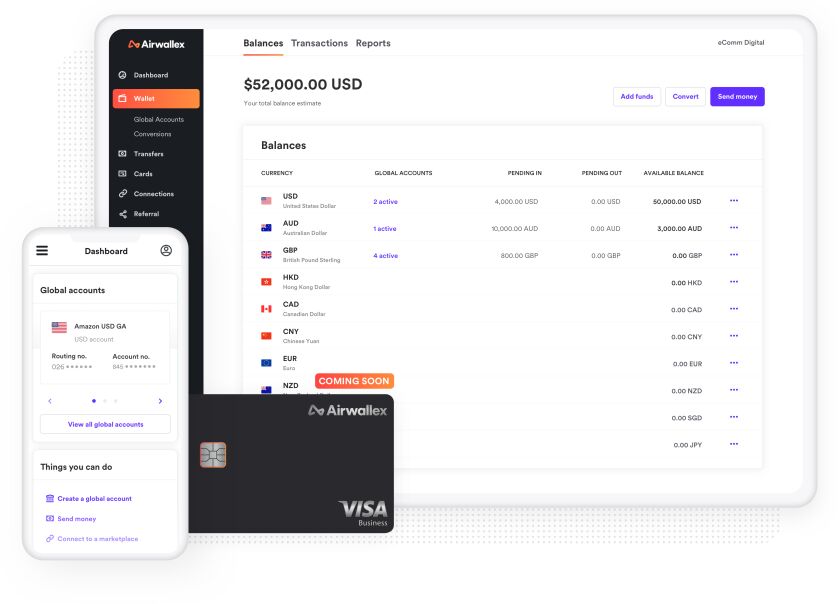

Airwallex is an Australian origin fintech offering business banking services for companies since 2015. Although not quite as capable (however) as Wise, they definitely have a practiced competitive product.

You can open up up to 11 unlike currency accounts for free to make and receive payments. The FX markup fees are 0.5% for main currencies and 1% for less mutual ones (0.3% and 0.6% for Australian customers). They use their own interbank rate, which is more than favorable than in near banks.

You can receive payments straight from Amazon, eBay, Shopify, and PayPal. They even have WeChat pay that allows businesses to receive coin from Chinese consumers easily. They also have a mobile app supported both on Android & iOS.

Only like Wise, they offering an integration with Xero for a meliorate accounting feel. They will sync your records hourly, and batch payments are also supported for more convenience.

Every employee can have their own virtual card and logins to keep meliorate rails of spendings. Card spending limits default to U.s.a.$ 10,000, but can exist increased on request. Physical cards and Apple Pay & Google Pay are currently simply bachelor in Australia, even so they are planning to launch the cards also in the US, the United kingdom, and Hong Kong.

Special offer: Airwallex will waive the FX mark-upwardly for the first AU$20,000 worth of transfers in any currency if you sign upward through this link.

Airwallex at a glance

Highlights

-

Payments possible in thirty currencies to 130 countries and more added

-

11 global accounts (USD, SGD, HKD, CNH, JPY, AUD, CHF, CAD, EUR, GBP, and NZD)

-

Directly payments from Amazon, eBay, Shopify, PayPal, and WeChat

-

No eolith limits to receive money in your account

-

Integrated with Xero

-

Separate cards and logins for employees

-

Mobile app for Android & iOS

Things to notation

Payoneer

Payoneer has been a pioneer in the international payments industry since they launched their USD receiving accounts back in 2011. For many people (e.chiliad. if you don't authorize for a Wise account) it'due south still the only selection for getting Usa account details or to become paid from many online marketplaces.

Note that you can only receive funds from companies (east.k. marketplaces such as Amazon or UpWork), not from private individuals—and so you can't use Payoneer to get paid from non-corporate clients.

While Payoneer has proved super useful to the otherwise unbanked—they also charge extremely high fees, so it's best to avoid them if you have other options bachelor to you.

Receiving USD costs i% of the transaction, other currencies free. Spending money with the Payoneer debit card (which costs $thirty/yr) costs three.5% if used outside the state of issue (typically US or UK) or if used in a different currency. ATM fees are high, exchange rates unfavorable (typically 2-three% markup), and even withdrawing money to a normal bank account costs 2%.

Payoneer at a glance

U.s.

Let's move on to the land of the complimentary. While you can still open a concern account as a not-resident in several large US banks—especially if you show upwardly in person and agree to a big initial deposit—that's impractical for about of united states of america.

Options such as Wise in a higher place is still good enough for most foreign companies, but if you have a Usa entity (even equally a non-resident foreigner) read on to learn how you easily tin can open a United states business business relationship remotely, for gratuitous.

Tip: If you need a proper US account for a primarily not-US business, it'due south cheap and pretty straightforward to register a not-resident LLC in many U.s. states, and it shouldn't have whatever taxation consequences. I'd recommend New Mexico and Wyoming for most purposes (peculiarly if yous value privacy), or Delaware in the instance you have ambitions of raising money or selling the business down the line.

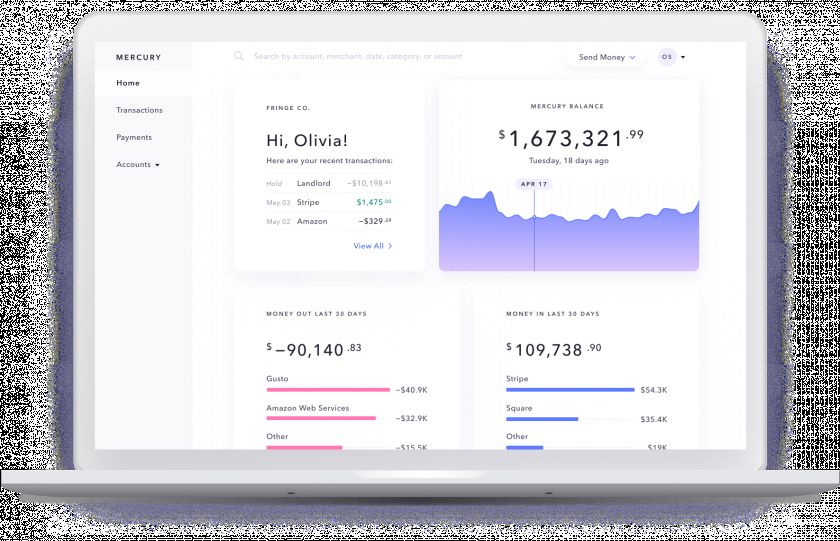

Mercury

I'm a bit surprised that Mercury hasn't received more attention in the location-independent business community since their launched in Apr 2019.

I have been talking about them on the forums for a while, but still I think this is ane of the first articles targeted at digital nomads, PTs and other location-independent people featuring them.

Anyway, my surprise at their lack of received attention aside, if you are a non-US resident with a US business (e.grand. LLC or corporation) who needs to an easy-to-use concern account, with low fees, that you can open up remotely—this is the i to go.

Literally the only thing they accuse for (and only considering they are passing on high fees from their partner bank) is wire transfers. Domestic are $5 (free for tea room customers) and international are $20. Notwithstanding cheaper than nearly whatsoever depository financial institution.

Everything else, including outgoing ACH transfers, ATM withdrawals, and foreign transactions are completely free of charge.

Mercury at a glance

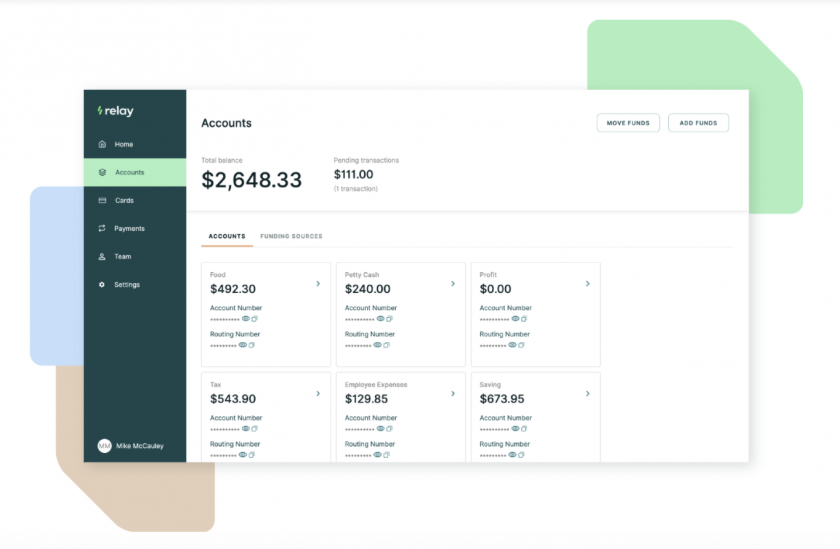

Relay

Some other great remote business banking platform for the U.s.a. is Relay. And this recommendation comes from our very own Nomad Gate readers.

Like Mercury, they only charge for wire transfers — $5 for domestic and $10 for international. Notwithstanding, for just $30 a month you can upgrade to Relay Pro, which comes with unlimited gratis wire transfers both domestic and international.

Information technology has other groovy business organization banking features such every bit the ability to effect debit cards to your team, set spending limits, track expenses, as well equally integrate accounting tools such as Xero and Quickbooks.

Relay at a glance

Europe

Holvi

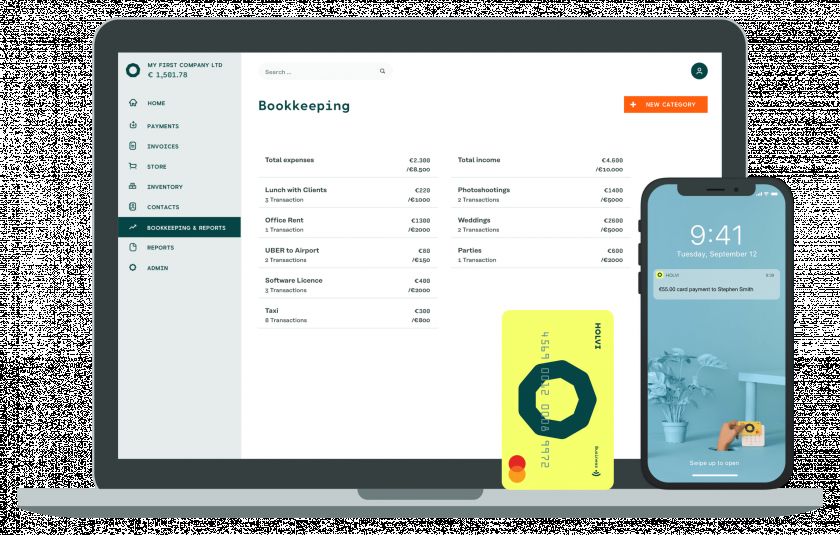

Holvi is a Finnish challenger banking concern (technically an payment institution as they don't accept a full cyberbanking license) that is at present owned by the Spanish

banking giant BBVA.

Their offering is a solid combination of business banking features, simple bookkeeping and invoicing features (from the €9/mo Grower plan and up).

You go a bright yellow Mastercard debit card and unlimited free SEPA transfers (if you're based in the Eurozone). Transfers outside the SEPA region is only possible with a tertiary party (I suggest Wise for this—see higher up) and you lot can likewise not receive non-SEPA transfers straight.

If you lot're based in the Britain, you can only send and receive national transfers in pounds.

Holvi at a glance

N26 Business

N26 is a German neobank who'south main claim-to-fame is one of the all-time personal bank accounts for travelers. Their business product is nigh identical—which is both good and bad.

On the plus side you get a fantastic mobile and web app, some of the lowest fees available in Europe, and some pretty handy budgeting features.

You also go unlimited free SEPA transfers. For non-SEPA transfers, you can utilize Wise (see above).

1 added bonus for the business business relationship (compared to the personal ane) is the addition of 0.1% cashback on all your purchases (or 0.five% for their metal carte).

You tin too get included travel insurance and nothing ATM withdrawal fees in strange currencies by opting for the Business organization You (€nine.90/mo) and Business Metal account (€16.ninety/mo). Yous'll likewise get car-sharing insurance, covering damage and theft to cars, and even scooters and bikes rented through a shared mobility programme. Business Metal plan besides adds motorcar rental insurance and phone insurance (up to €1,000 covered for theft and damage). Now in that location is also COVID-19 coverage for trips that started on or after January 22, 2021. It covers you and your travel companion if you accept to abolish or shorten your trip due to becoming ill, having to quarantine, or upwardly to €1,000,000 emergency medical bills. So you can have extra peace of mind.

The drawback of the N26 account is that information technology's merely bachelor for freelancers and self-employed. You lot can't use information technology for an incorporated business organization. It'due south also pretty weak when it comes to accounting and invoicing features (they are pretty much absent).

N26 Business at a glance

Monese Business

Monese is (like N26) peradventure all-time known for their personal cyberbanking product, but their business account is as well keen!

Together with Tide (beneath) and Wise information technology's one of the few banking options for not-Uk residents with a UK registered company.

It does come with a small monthly fee (£9.95), merely the included services are more than than worth it.

Yous'll get vi free ATM withdrawals per month, only 0.v% currency markup on spending and international transfers, and gratis incoming and outgoing bank transfers, including direct debits.

Monese Business at a glance

Tide

The UK is one of the near popular jurisdictions for location-independent businesses due to several factors such equally a stellar reputation, good access to services such as merchant accounts, and a skillful concern environment.

The simply significant obstruction for location-independent U.k. businesses with non-resident owners/directors was to open up a bank account. No UK banks wanted to work with non-residents (unless you were bringing loads of business to the bank).

That was the situation until 2016.

Enter Tide.

Finally, there was a banking solution bachelor to non-residents with United kingdom of great britain and northern ireland registered companies!

Not but that, Tide also comes with automated transaction categorization, bookkeeping integration, multiple accounts, easy invoicing, and fully featured mobile and web apps.

Tide at a glance

Honorable mention: Starling Banking company

I would like to quickly mention Starling Bank while discussing banks for UK companies . It's a great selection, if both you and the business are resident in the Great britain. It's not open to not-UK residents, unfortunately.

If y'all authorize, definitely check information technology out. They have a completely free plan, including free spending away. If you want more advanced accounting features y'all tin can add the Concern Toolkit onto your free business or sole trader business relationship for £7 per month, the starting time month is free.

Bunq Business

Bunq is another bank that's probably more than known for their excellent personal accounts. But if you run a business based in the Netherlands or Federal republic of germany, then Bunq's business organisation business relationship may be what you're looking for.

It offers bookkeeping integrations with many Dutch accounting systems (and some High german). And in case there'southward not direct accounting connection you tin can request automated monthly CSV exports to transport to your accountant or upload to your own bookkeeping software.

Bunq Business comes with loads of other useful features, like multiple banking concern accounts, access for multiple users (to the whole business relationship or simply parts of it), and automatically setting aside VAT for your incoming payments and then you'll never come up short come revenue enhancement day.

Bunq as well strives to be an ethical bank, with responsible investment policies and you tin even take control over where your money is invested.

Bunq Business at a glance

Paysera

While it wouldn't exist my first option, Paysera is still a feasible choice if your concern needs an EUR account and does not qualify for any of the options above.

They claim to back up over 180 countries, just that may no longer be the case. I've reached out to Paysera to get more data about where they now accept companies from, but oasis't yet heard back.

Paysera at a glance

Asia

Aspire

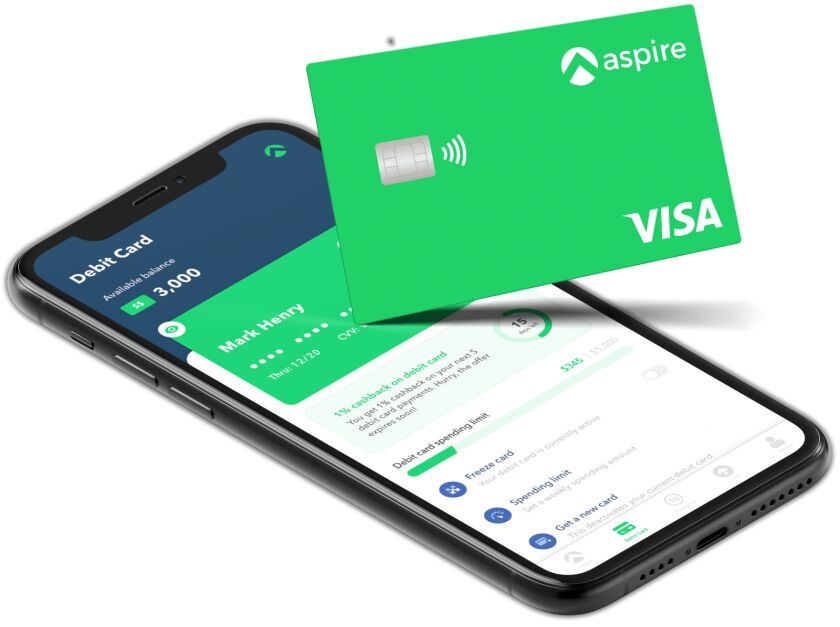

Singapore has 1 of the near favorable jurisdictions for businesses in Asia and very pop for location-contained entrepreneurs. While information technology's usually possible to open business bank accounts with several Singaporean banks for non-resident owners, information technology typically requires in-person visits, a ton of paperwork, large minimum deposits, and often high charges for both account maintenance and transfers. So it's no wonder that in 2019 Aspire was voted the number 1 hottest startup by Singapore Business Review.

Opening a concern business relationship with Aspire is as piece of cake as it gets. The signup is done online in 5 minutes, your business relationship and a virtual carte will be prepare in as quick as an hour. Oh, and I should probably mention that it's gratuitous to open, there are no monthly fees, and no minimum deposit. Currently, you can have SGD and USD business relationship with them.

It offers cheap international transfers at the mid-market charge per unit, easy bookkeeping, and 1% cash-dorsum for some business organization costs. As well, you lot tin apply for a line of credit easily in your Aspire account. Their convenient expense management system allows you to take a separate bank card for each employee with their ain proper noun and specified spending limits.

Aspire at a glance

Neat

Hong Kong is one of the nigh popular jurisdictions for digital nomads to annals their businesses. Nonetheless, getting a multi-currency account for a Hong Kong business—especially equally a not-resident owner—has gotten increasingly difficult over the by few years.

Neat to the rescue!

They will let foreign owners of Hong Kong businesses open an account online in only minutes. No need for an in-person meeting.

The business relationship comes with a local account number, but isn't a true banking company account and isn't covered past the Hong Kong Deposit Protection Scheme. Still, it's much better than no bank business relationship at all.

The account also comes with a corporate Visa card which can be used worldwide.

Not bad Business at a glance

Other banks and regions

Almost of the banks listed so far in this article are and so called fintechs or neo banks. They piece of work great for many types of businesses, just sometimes y'all may take more than specific needs, or require services not offered by this type of banking concern.

Maybe you require an account in a specific country, or your business is incorporated in a jurisdiction that nigh banks won't open accounts for? Or perhaps your business is classified as "high risk" by most banks?

If this is the case, you may want to open an account with a more established bank, or one that's willing to work with more "loftier gamble" clients. While this isn't always straightforward, it'due south more than doable if you lot're armed with the correct information.

I'd recommend that y'all stay away from so-called "bank introducers" that oftentimes accuse thousands of dollars to innovate you lot to banks that would accept accepted y'all anyway if y'all had applied direct. They don't add much, if any, value.

Instead, I'd recommend asking people in your network who have successfully opened the type of account y'all're looking for. Or if you don't know anyone you can ask, I'd recommend signing up for a service like GlobalBanks.

They maintain a database of hundreds of banks in 50+ countries, including information virtually account opening requirements, fee schedules, reviews, tips for applying, including contact persons at many of the banks, whether yous can open remotely, so on.

Let me know in the comments if you know any other good options, or if yous have any feedback about any of the ones I listed above!

Source: https://nomadgate.com/best-business-banks-open-remotely/

Posted by: townsendhowles1955.blogspot.com

0 Response to "Do I Need An Ni To Register A Company In Uk"

Post a Comment